Professional Asset Management. Simplified

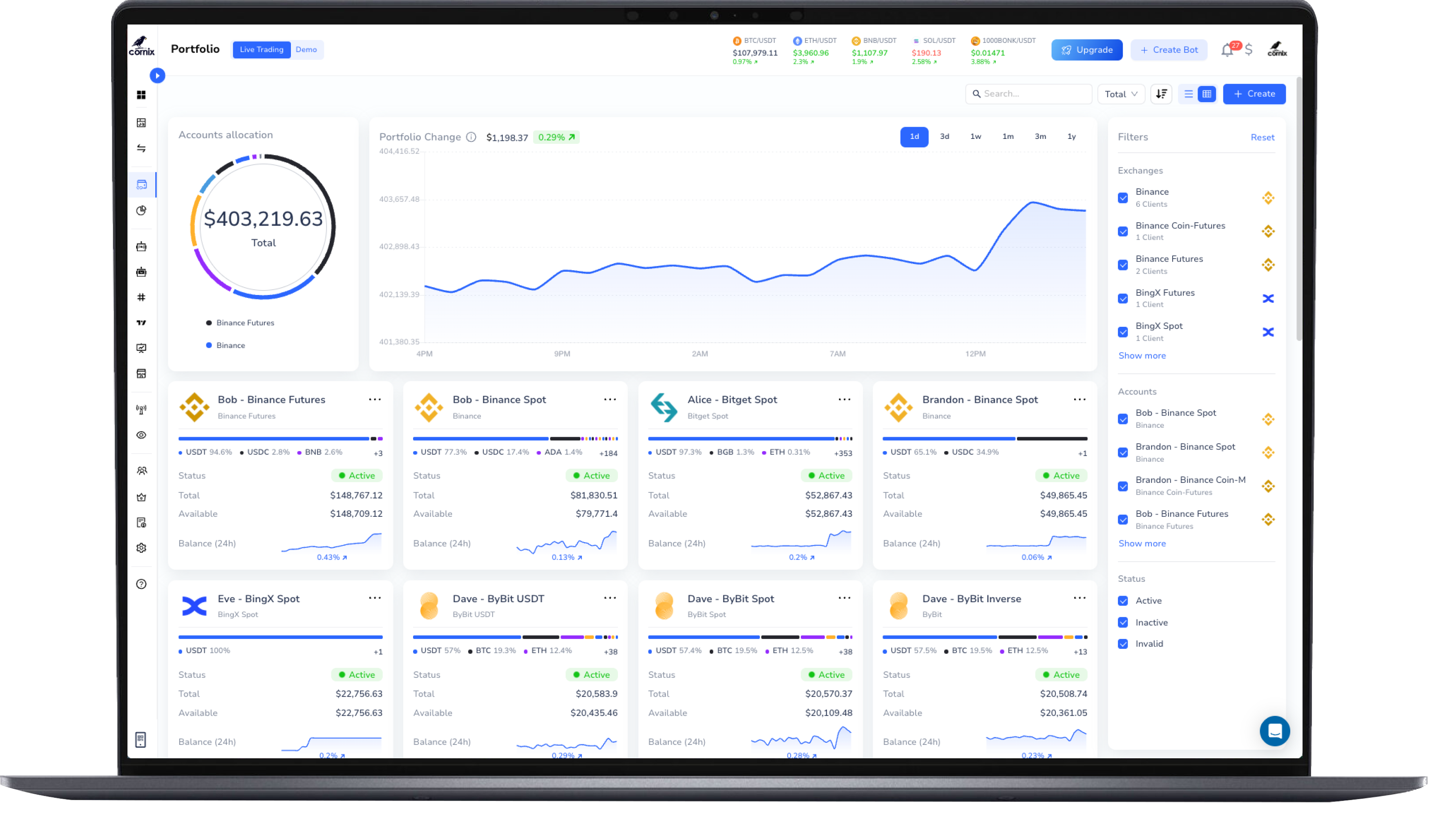

Manage multiple client accounts, execute trades across exchanges, and oversee performance, all from one secure, non-custodial platform.

Cornix empowers asset managers to operate efficiently across multiple client accounts without ever taking custody of funds.

Onboard clients securely, automate trading across exchanges, and deliver full transparency with real-time, auditable performance data.

Seamlessly onboard clients with a secure invite link that allows them to connect and approve access to their exchange accounts in seconds.

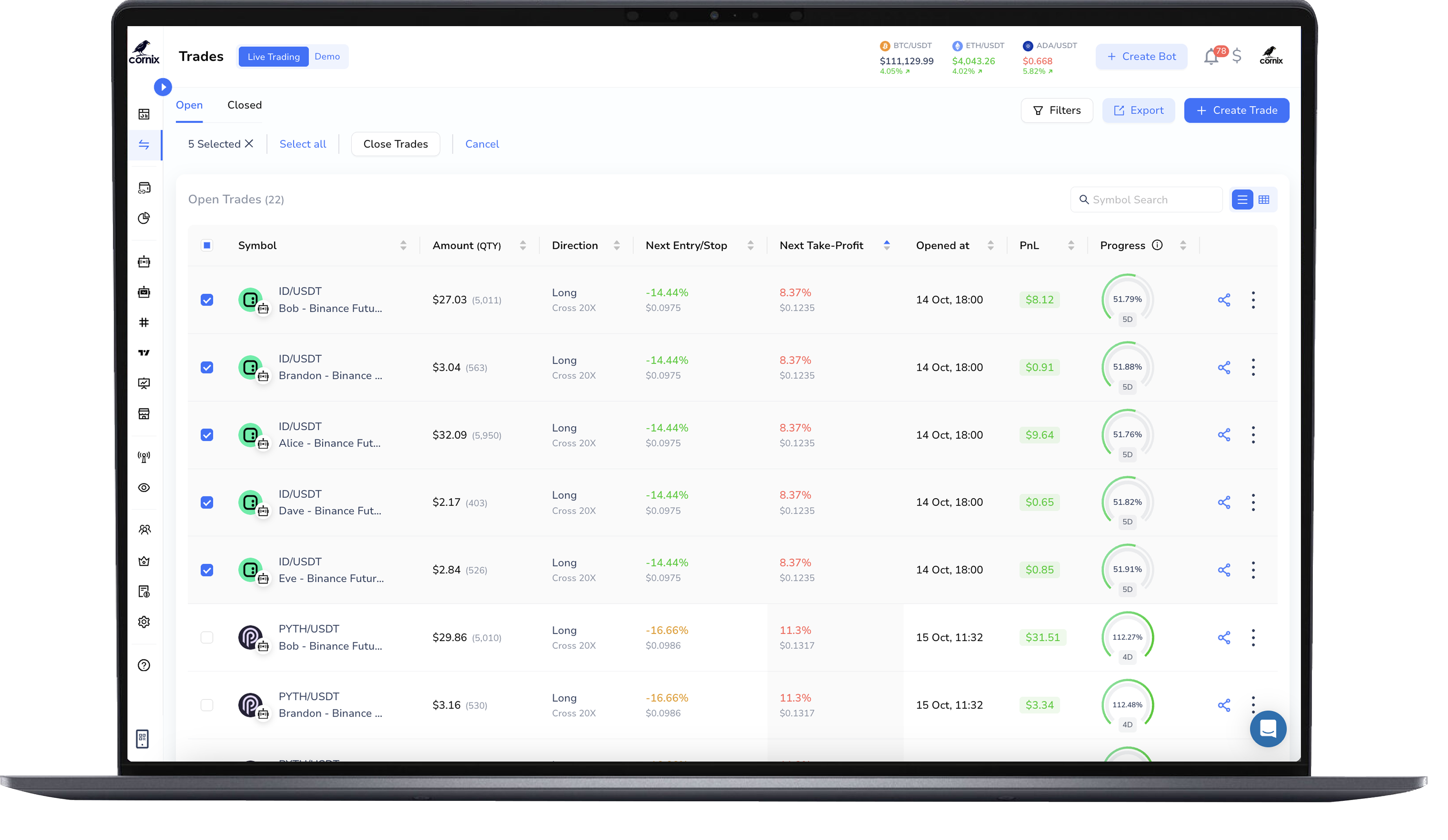

Choose how each account trades: set up signal bots, DCA bots, grid bots, or manual trading configurations for streamlined management.

Deploy trades across multiple accounts instantly and track live performance with full transparency.

Who is Cornix Asset Management designed for?Cornix is built for professional traders, asset managers, funds, and organizations managing multiple client accounts. It provides the tools to automate and oversee trading activity across exchanges without taking custody of client funds.

Why is Cornix effective for asset managers?Cornix simplifies account management and execution by consolidating everything into one secure, non-custodial platform. Asset managers can execute trades, configure bots, and track performance across multiple accounts in seconds, reducing operational overhead while maintaining full transparency.

How does Cornix Asset Management work?Asset managers invite clients to connect their exchange accounts securely through a one-time approval link. Once connected, managers can create and deploy trading strategies such as signal bots, DCA bots, or grid bots across all client accounts. Cornix handles trade execution through API integration without exposing credentials, ensuring complete control and safety for both sides.

How do I connect a client’s account to Cornix?Send the client a secure invitation link. After they approve and connect their exchange account, you can immediately begin trading and managing on their behalf. Clients retain full ownership of their exchange accounts and can revoke access at any time through their Cornix dashboard.

What sets Cornix apart from other asset management solutions?Cornix combines institutional-grade automation with non-custodial safety and unmatched usability. Managers can operate hundreds of client accounts from a single dashboard, perform bulk actions across bots and trades, and access real-time reporting and audit-ready transparency. Unlike most solutions, Cornix allows instant onboarding and management with zero custody risk, making it both scalable and compliant.

Which exchanges are supported?Cornix integrates with leading exchanges including Binance, Bybit, Bitget, OKX, and others, providing seamless execution across your preferred platforms.

Can I customize strategies for each client?Yes. You can define unique configurations for each client account, from bot setups and trading strategies to risk parameters and allocation settings, all managed through a unified interface.